Introduction

Stablecoins are positioned to become the next dominant payment infrastructure.

They solve the inherent problems of speed, cost, and access that traditional payment systems cannot overcome.

This is not a minor improvement but an architectural leap, promising a global, instant, and low-cost payment system for everyone.

$125 trillion

$700 billion

Summary

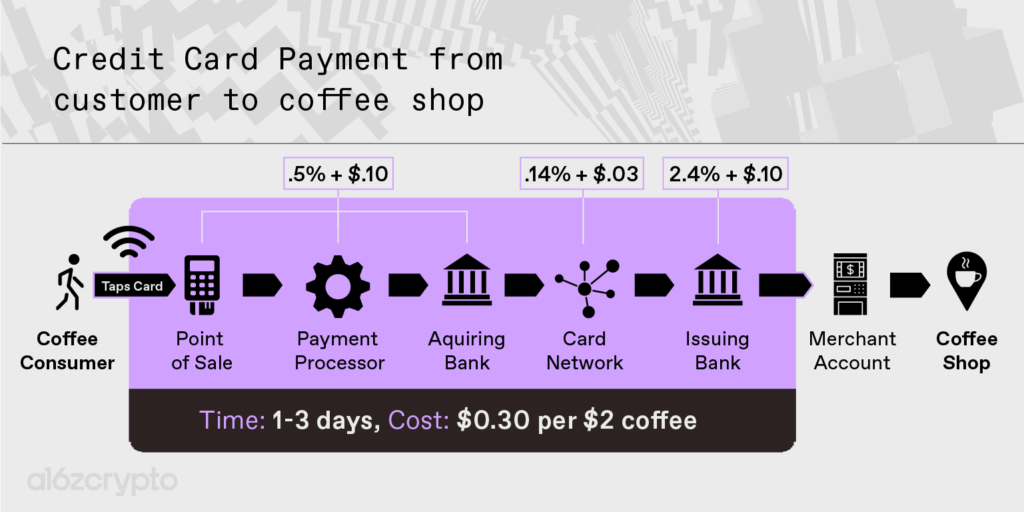

The current payment infrastructure, built decades ago, has inherent weaknesses. Systems like ACH are slow and operate only during business hours, while credit card networks are high-cost, averaging 2-3% in fees. These systems exist as “walled gardens,” lacking interoperability and creating hidden costs for both businesses and consumers.

Stablecoins emerge as a superior solution because they are built on public, borderless blockchains. This delivers three core benefits:

Global Interoperability: Stablecoins can be sent and received anywhere with an internet connection, independent of any specific country’s banking system.

Near-Instant Settlement: Transactions are confirmed in seconds instead of days.

Drastically Lower Costs: Transaction fees on modern blockchains cost just a few cents, significantly lower than credit card fees.

The adoption roadmap for stablecoins in payments is not expected to happen all at once. It will begin in markets and use cases where the pain points of cost and speed are greatest, including B2B cross-border payments, remittances, and payments for digital economies like the creator economy and gaming. As infrastructure and user experience improve, stablecoins will gradually expand into e-commerce and daily consumer payments.

Disclaimer: This summary was generated by an Artificial Intelligence (AI). It is a condensed version of the original article and, while it aims for accuracy, may not capture every nuance or detail. For a complete understanding, please refer to the original source.

Source: “How stablecoins will eat payments, and what happens next ”

a16zcrypto